- Offers

-

Carpets

-

Colours

-

Grey Carpet

-

Beige Carpet

-

Cream Carpet

-

Brown Carpet

-

Blue Carpet

-

Green Carpet

-

Red Carpet

-

Purple Carpet

-

Pink Carpet

-

Black Carpet

-

Silver Carpets

-

Dark Carpets

-

White Carpet

-

Multicolour Carpet

-

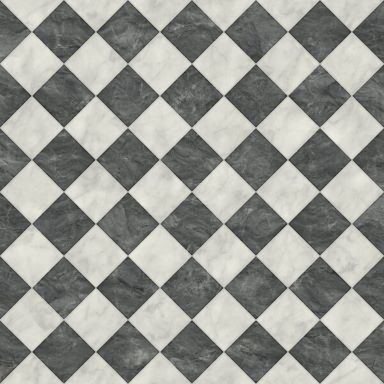

- Vinyl Flooring

- Laminate Flooring

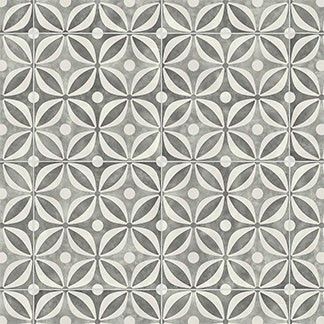

- Luxury Vinyl Tiles

-

Engineered Wood

- Ideas Hub

- CLOSE